About

Goals & Objectives

Elements

Research & Public Engagement

Regional Element

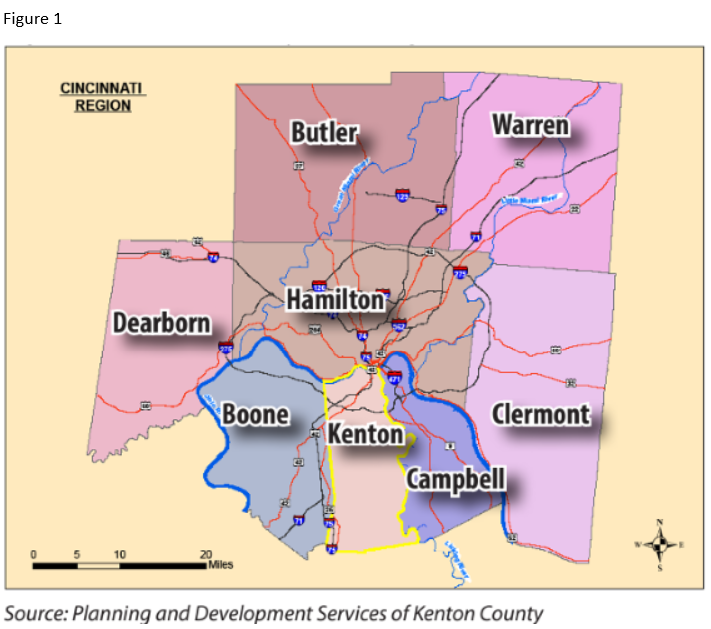

Kenton County is one piece of a larger 8-county, 3-state, Greater Cincinnati area and plays an important role in the overall region’s success. The Cincinnati metro region is competing for jobs and talent with 11 peer regions around the country. Read on to learn more about how the region affects the county’s future and vice versa.

The Kenton County Comprehensive plan is comprised of nine elements. Recommendations and associated tasks for implementation have been developed for each element to implement the Goals and Objectives that serve as the foundation for the plan. The recommendations were derived after extensive public discussions, discourse and dialogue and are based on research which includes local data as well as national trends. They explore different facets of the county’s physical development as well as its economic and social well-being and provide a roadmap for implementation. Kenton County is a single part of the Greater Cincinnati Metropolitan Region. The Kenton County Comprehensive plan examines the role of Kenton County in the overall region. The Regional element identifies policies that recognize that decisions made locally have an impact on the overall metropolitan region.

The Kenton County Comprehensive plan is comprised of nine elements. Recommendations and associated tasks for implementation have been developed for each element to implement the Goals and Objectives that serve as the foundation for the plan. The recommendations were derived after extensive public discussions, discourse and dialogue and are based on research which includes local data as well as national trends. They explore different facets of the county’s physical development as well as its economic and social well-being and provide a roadmap for implementation. Kenton County is a single part of the Greater Cincinnati Metropolitan Region. The Kenton County Comprehensive plan examines the role of Kenton County in the overall region. The Regional element identifies policies that recognize that decisions made locally have an impact on the overall metropolitan region.

Kenton County is linked in a regional context to three states, 16 counties, and over 200 municipalities. Each one of these geopolitical jurisdictions has different goals and aspirations. While these ambitions may suit residents and cities on a micro level, the economic health of the entire region is dependent on each of the jurisdictions considering their role in a broader context. Kenton County is located in a particularly important part of this metro area, being geographically in the center and containing a part of the urban economic and employment core of the region. While the elements of this plan are mostly focused on Kenton County, it is important to realize that the health of Kenton County is intimately linked to the health of the entire region. Click on the main headings below to learn more about the recommendations for regional planning as it pertains to Kenton County.