About

Goals & Objectives

Elements

Research & Public Engagement

Housing Report

Housing is a critical element that drives population and economic growth. The provision of a variety of housing in different price ranges is important in retaining and attracting people to the County. This report examines the housing market of Kenton County including household characteristics, housing development, and the changing nature of the population that will influence the housing market in the area. An understanding of the current housing market along with population trends can assist in identifying future demand for different housing types.

Participants at recent community engagement events for the 2024 Comprehensive Plan Update indicated that availability of housing for all incomes and generations was one of top subjects for community members. Housing was also the second most important element to respondents. This feedback proves valuable that housing in Kenton County is top priority among our citizens.

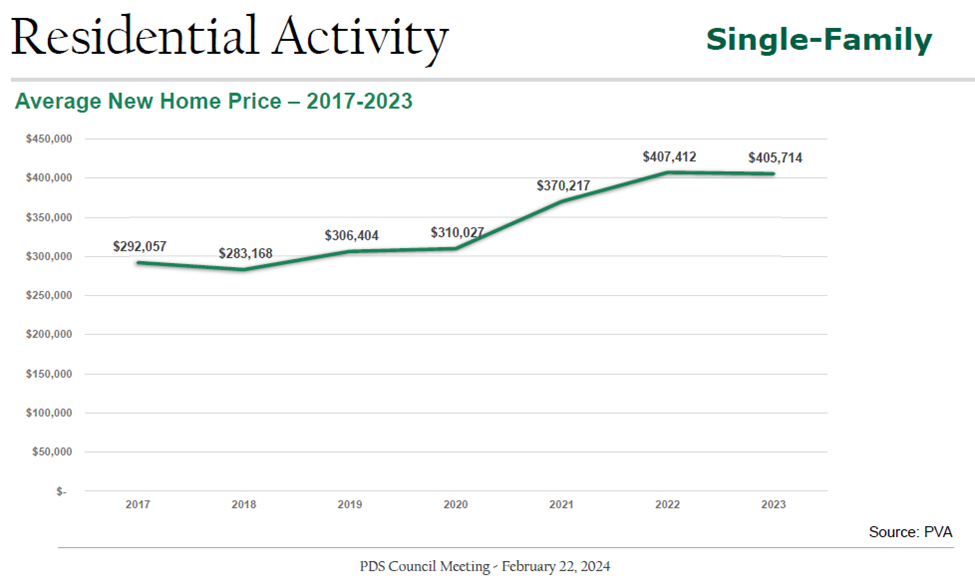

Since the COVID-19 pandemic, median housing prices have rapidly increased. Workforce creation has outpaced workforce housing which has resulted in employees being forced to spend more on housing or face longer commutes from neighboring counties. This also creates difficulty in recruiting for employers.

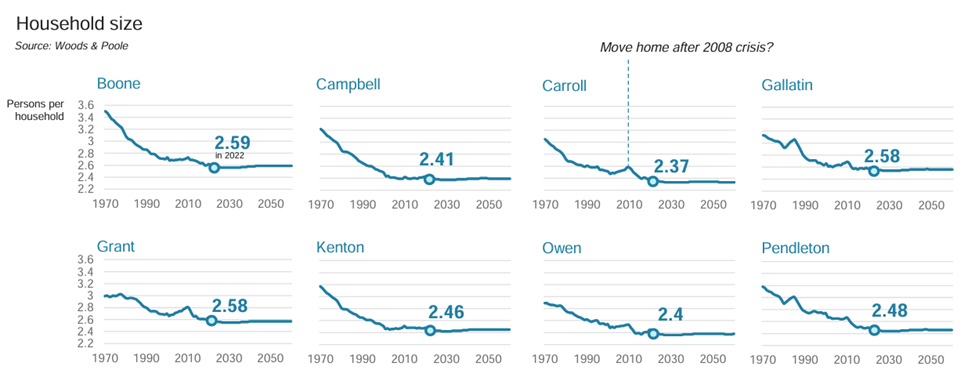

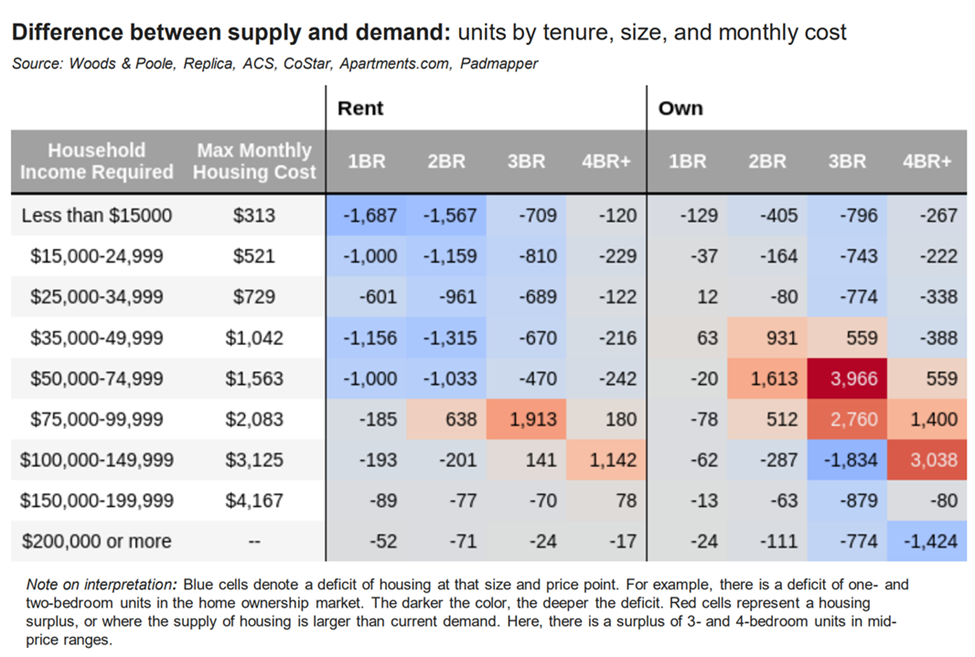

In the Northern Kentucky region, the average household size has dropped as a result of fewer large households and more households without children but is steadying across all counties. The average household size in Kenton County has been steadily decreasing from the 1970s, although it has started to slowly level off. As of 2023, the average household size is 2.46 persons per household. The type of housing that is being most built includes three and four-bedroom homes which do not account for a diversity of incomes and smaller household sizes throughout the region. In the Northern Kentucky region, there is also an existing gap for rentals that are available to people at the lowest levels of income.1

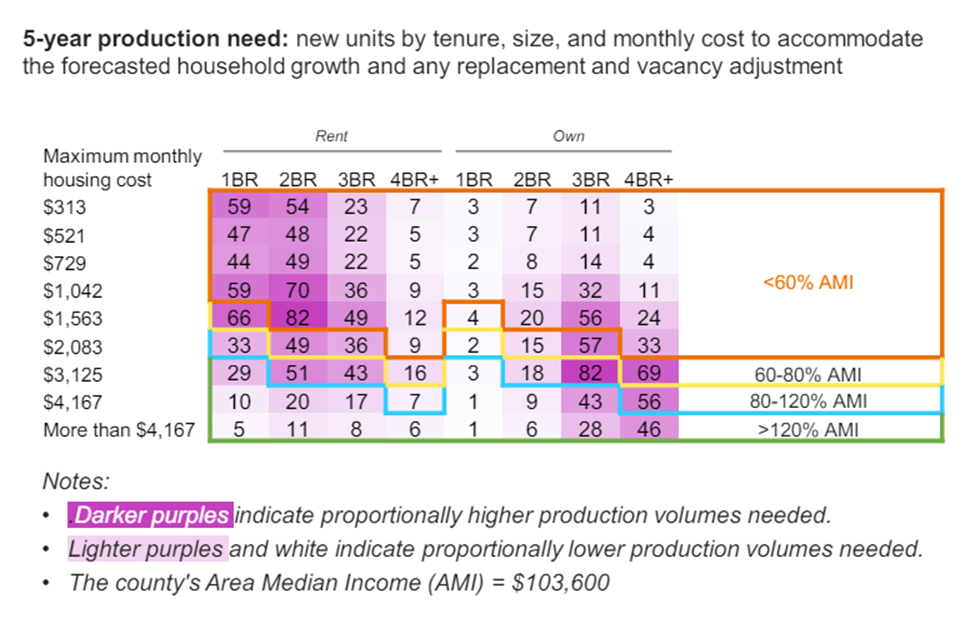

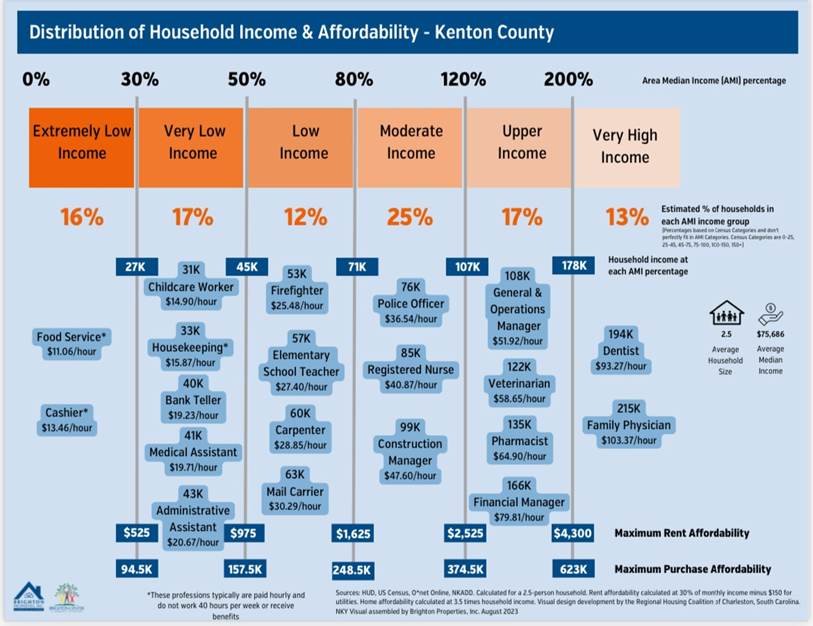

Kenton county is adding wealthier households to the community, creating an expectation for the upper income population to grow; however, in the Northern Kentucky area, there are currently 2.68 workforce jobs for each housing unit they could afford. Workforce jobs are defined as having an annual average salary below $60,000 as of 2023. This has resulted in an increased need for workforce housing. Workforce housing is defined by the Urban Land Institute (ULI) as housing that is affordable to households earning between 60 and 120 percent of the area median income (AMI).2 The AMI for Kenton County as of 2023 is $103,600.1 A snapshot of Kenton County’s 5-year production needs relative to AMI can be found in Figure 2 below.

In 2022 to 2023, 870 new multi-family residential units were built primarily in Covington. It is projected that after 2024, 927 additional multi-family units will come on the market including locations in Ludlow, Crestview Hills, Fort Wright, and Covington. One hundred seventy-two townhomes and condominiums have been built in Covington, Crescent Springs, and Taylor Mill around 2023. There are currently 413 townhomes and condominiums under construction as of 2023 in Fort Mitchell, Ludlow, and Independence.3

New developments in the suburbs tend to be three to four-bedroom tract housing subdivisions targeted for middle to upper-middle class incomes. This form of development is relatively overdeveloped in Kenton County. Kenton County is missing one and two-bedroom homes across most income levels. These types of homes cater to an aging population, a demand for entry level homes, as well as families with smaller household sizes. Kenton County is also missing three-bedroom rentals for lower income households. Mixed-use developments including duplexes, triplexes, townhomes, apartments, and condominiums either for rental or ownership could help to fulfill these unmet needs.1

The NKADD 2023 Housing Data Analysis Report estimated that an additional 1,827 units will need to be built by 2028 “to accommodate projected new households while also incorporating other market dynamics such as organic unit replacement and vacancy fluctuations.”1 Higher density residential development should be considered to reduce greenfield development in exurban fringes. This can include multifamily buildings as well as attached single-family homes such as duplexes, triplexes, four family, and multifamily units. Jurisdictions throughout Kenton County should identify areas that have infrastructure and utilities in place for such development and allow increased densities in these areas as a permitted use. Compared to the national average vacancy rate of 9.7 percent, the vacancy rate in Kenton County is roughly 6.8 percent vacancy.4

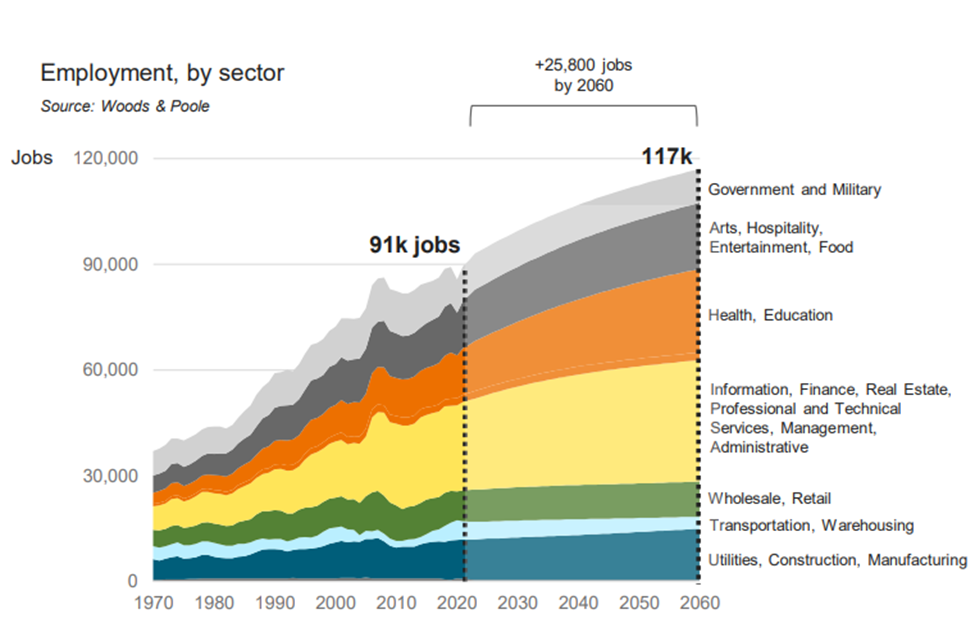

Kenton County is an employment hub made up of corporate offices, hospitals, warehousing and higher income jobs with the largest amount of healthcare and education jobs of the Northern Kentucky counties. Approximately 64.9 percent of Kenton County residents work in white collar jobs, 23.2 percent in blue collar jobs, and 12.9 percent in service jobs. Kenton County has the largest share of jobs in healthcare and education of any county in the Northern Kentucky region. Figure 3 shows the employment by sector gathered by Woods and Poole with their projections comparable to other regional forecasting.1

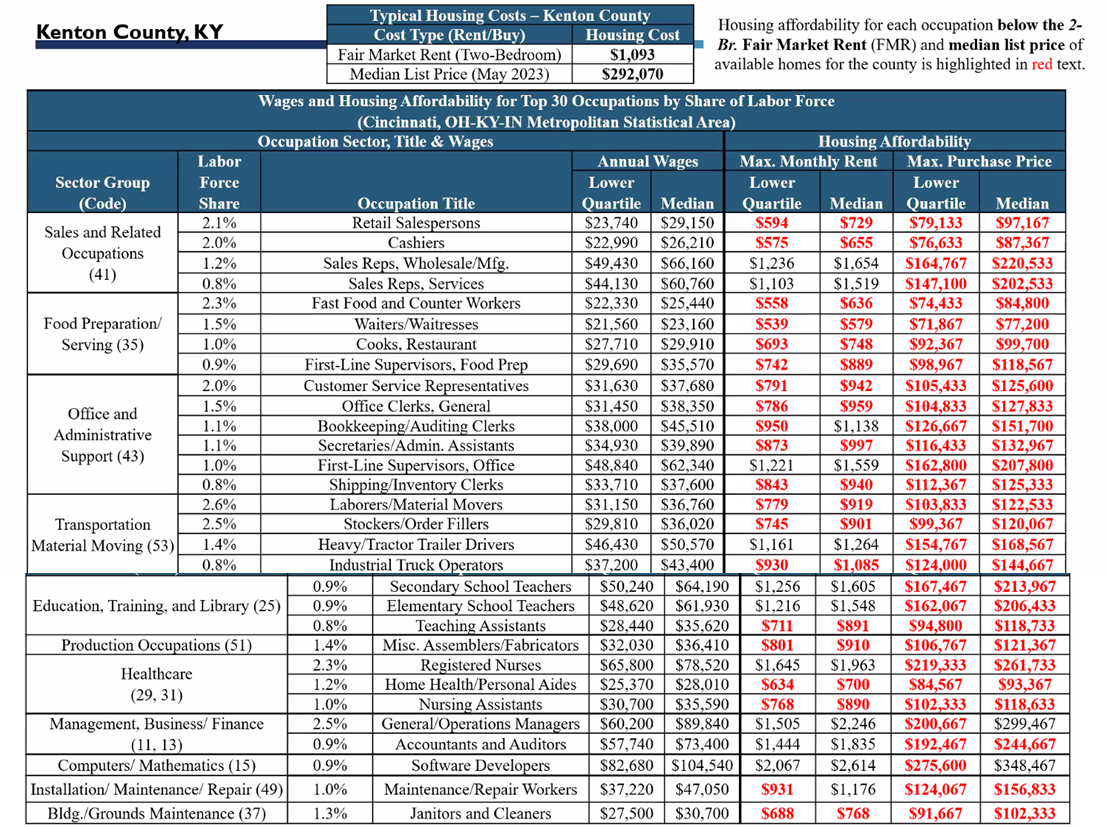

The large number of lower wage service sector workforce earning significantly less than professionals causes poverty and rent burdened households within Kenton County.1 A better depiction of this is evident in the Kenton County housing costs and affordability data in Figure 4 derived by Kentucky League of Cities’ Virtual Summit regarding Kenton County’s housing affordability and occupation annual wages5 as well as Brighton Center’s Blue Sheet of household income and affordability in Figure 5.6

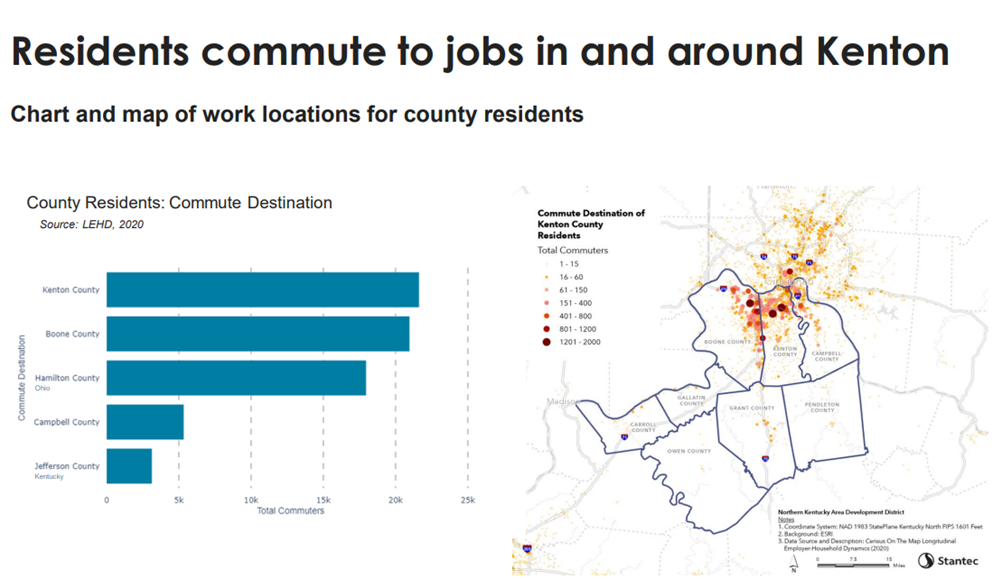

Because Kenton County is largely an employment hub, people from many other areas commute to the county for work (See Figure 6). Approximately 40 percent of non-resident commuters would potentially live in Kenton County if adequate income-aligned housing was provided.7

There are 49,160 detached housing units, 2,853 one unit attached housing units and 21,243 multi-family housing units in the county for a total of 73,256 housing units per the 2022 American Community Survey One Year Estimate.4 In the rural area, detached housing has increased substantially during the past three decades but is still a small amount of the overall housing supply compared to the other three areas.

To better understand housing development in Kenton County residential development was divided into three eras: before 1946, 1946 -1983, and after 1983. These eras were applied to the four different sub areas of the county including urban, first-ring, suburban and rural.

- Urban

- Urban housing makes up 23 percent of all housing stock in the county. Eighty-four percent of the housing in the urban parts of Kenton County was built before WWII. Urban housing generally consists of a mixture of hi, mid, and low rise apartments as well as attached and detached single-family housing.

- First-Ring

- First-Ring housing comprises 27 percent of the housing for the county. Eighty-six percent of housing within this area is detached and 55 percent of this was built between 1946 and 1983. Some housing is still being constructed in this subarea; however, detached housing is being built at a reduced rate. Most of the attached housing (92 percent) primarily consists of condos which were built after 1946.

- Suburban

- Suburban housing comprises 45 percent of the county’s housing stock. Housing in the suburban area was modest before 1946 but grew substantially afterwards. Most suburban housing consists of garden style attached housing, condos, and single-family housing.

- Rural

- The Rural subarea contains only five percent of Kenton County’s housing stock. This area is sparsely populated and contains almost no attached housing. The majority of the houses have been built during the last 30 years.

Based on data collected between 2017 and 2023, the average household size is 2.47. $75,686 is the median household income while $405,714 is the average new home price as of 2023 per the Kenton County Property Valuation Administrator.8 These imbalances combined with rapidly increasing housing costs can put home ownership out of reach for many residents of Kenton County while also making it more difficult for current homeowners to downsize or upsize as needed. Thirty-three percent of households rent, while 67 percent own their homes.

Kenton County is expected to experience steady population growth until 2060 with an estimated increase of 20 percent (19,000 residents). This will bring the total population to an estimated 189,000 residents. Of the 19,000 residents, there will be a 25 percent shift towards an older demographic (4,750 residents).1 National trends and surveys indicate that aging in place is the preferred housing arrangement for seniors. Some seniors will want to stay in their neighborhoods but live in a smaller house with greater accessibility if those options are available. With the estimated increase of the senior population within the County, it is important to analyze the availability of smaller housing units within desirable neighborhoods including options such as permitting accessory dwelling units by right.

Younger generations face two challenges as they move into young adulthood. Poor employment prospects and high debt levels have slowed the formation of new households and new home buying for the past several years. Younger generations also seem to prefer renting in urban areas rather than buying detached housing in suburban areas due to varied reasons. Younger generations do not have children, they prefer to live close to amenities where they can socialize with their friends, and they prefer the dense walkable environments where they do not have to spend time driving to their daily activities. Jurisdictions should identify areas within their communities that are appropriate for increased residential density.

As generations mature and grow their families, they tend to prefer homes in suburban communities. This includes individuals that are towards the end of their careers and have high school to college-aged children. This group tends to look for larger houses with large lots in the suburbs to accommodate their families. They would like to be close to amenities, but the size of the house and yard are more important at this time.

An important issue rising in the housing market is walkability. Studies are finding that more people from all generations want to live in a community with sidewalks and trails that lead to amenities. The 2023 Community and Transportation Preference Survey, conducted for the National Association of Realtors, found that 79 percent of respondents rate being within an easy walk of other places and things in a community, such as shops and parks as very important or somewhat important when deciding where to live. Seventy-eight percent of respondents also stated that when moving to a new home they would be willing to spend more to live in a community where they could easily walk to parks, shops, and restaurants.9

As seen in Figure 8 above, it is no surprise that Kenton County’s housing supply does not reflect the demand as mentioned previously in this report. The pricing pressure could be relieved by the utility of more mixed-use development to include a mixture of residential uses in conjunction with commercial uses1 which also offer the walkability and closeness to commercial centers and amenities that all generations are looking for when buying/renting.

The unmet needs of supply and demand evident in the county is only one issue causing market prices to soar. Another issue on a national level is the Baby Boomer generation causing home prices and the cost of rent to rise. They are not moving out of their homes whether it be because they are price locked in their current homes or have limited housing options for aging in place to allow them to move into a more accommodating unit for their needs. This makes the affordable homes unavailable for first home buyers, forcing the first home buyers to buy new homes that are often not within an affordable price range.10

Statistics show 67 million U.S. homeowners are over the age of 55 and own about two-thirds of all U.S. home equity. Approximately 63 percent of these homeowners plan to age in place while the rest plan at least one more move. Majority of those that plan to move will choose to rent their next home causing another concern that the affordability of rental housing will be strained. It is important to note that regardless of demographic shifts or concerns with the baby boomer housing price strain, numerous findings indicate “the differences in house prices across cities are more closely related to variability in employment rates, to growth in real incomes and to construction costs than to demographic shifts.” 10

Residential neighborhoods can decline quickly if left unattended resulting in code enforcement cases, foreclosure, and demolition. Properties in declining neighborhoods lose value and reduce property taxes. Communities should collaborate with housing agencies, neighborhood groups, social service agencies, and the development, construction, and financial institutions to identify neighborhoods with declining property values. Jurisdictions should be mindful of community input and attempt to balance the voices of current residents with the needs of future residents.

Rehabilitation of existing housing communities or non-residential buildings will improve the marketability of these communities and make them more attractive for reinvestment. Areas where existing non-residential buildings can be rehabilitated for residential uses should be identified and funding mechanisms for potential residential conversions should be explored. These renovations and rehabilitations of underutilized space can also help to better activate nearby areas.

In 2023, the former Kenton County Administration Building and jail in Covington was redeveloped into a downtown apartment building with an over $31.4 million dollar investment. The retrofitted building includes 133 residential units spread over 12 floors and 4,400 square feet of commercial space on the first floor. The building was stripped to its concrete core and transformed into new residential living spaces with views of downtown Covington and nearby Cincinnati. This project is a great example of repurposing and retrofitting existing buildings to supply more housing options.11

Over the past few decades, Kenton County’s housing market encountered similar challenges as the rest of the nation. Housing prices increasing during COVID-19 combined with rising interest rates have created issues with housing affordability across generations. Restrictive monoculture zoning practices including larger minimum lot sizes have also contributed to issues with affordability.

The housing market is likely to undergo significant changes in the coming decades. The housing market for senior citizens and young adults will need to be monitored closely and the appropriate housing units built accordingly to ensure that needs such as smaller more accessible homes are being met. To remain competitive, efforts to redevelop existing communities and build new communities with a balanced supply of housing options that are more walkable to nearby amenities are needed.

- Northern Kentucky Area Development District. (2023, September 13). Northern Kentucky Housing Data Analysis. https://www.nkadd.org/northern-kentucky-housing-data-analysis/

- Urban Land Institute. (2024). https://uli.org/

- Planning and Development Services. (2024). Building Permit Data.

- United States Census Bureau. (2024). https://data.census.gov/

- Kentucky League of Cities. (2023, November 15). KLC Virtual Summit. Housing & Hope. https://link.edgepilot.com/s/ad78b082/h7pbQe4yiE2UbOLpx_CegA?u=https://kleague-my.sharepoint.com/:f:/g/personal/lroberts_klc_org/EnB9nRjvDO9OgDxVRMSwr1cBnDJnsJHyzpZtpmr6V3W56w?e=2ncXh5

- Brighton Center. (2024, May 7). Distribution of Household Income & Affordability – Kenton County Blue Sheet. Northern Kentucky Housing Coalition Meeting, Erlanger, Kentucky.

- Kentucky Housing Corporation & Bowen National Research. (2024, May 21). Housing Gap Analysis Data. https://www.kyhousing.org/Data-Library/Housing-Gap-Analysis/Pages/Data.aspx?utm_source=eGrams&utm_campaign=dbd29b277c-EMAIL_CAMPAIGN_2024_05_23_01_48&utm_medium=email&utm_term=0_-dbd29b277c-%5BLIST_EMAIL_ID%5D

- Kenton County Property Valuation Administrator. (2024). https://www.kentonpva.org/

- National Community and Transportation Preferences Survey. April 2023. National Association of Realtors. Accessed from https://cdn.nar.realtor//sites/default/files/documents/2023-community-and-transportation-preferences-survey-slides-06-20-2023.pdf?_gl=1*ho2w1s*_gcl_au*MTQ1NjAxMTg4OC4xNzEwOTQ0MDYz

- Kupiec, P. H. & Pinto, E. J. (2020, January 6). Are Baby Boomers Ruining the Housing Market for Everybody Else? American Enterprise Institute. https://www.aei.org/articles/are-baby-boomers-ruining-the-housing-market-for-everybody-else/

- Miller, A. (2023, March 20). Former Kenton County Administration Building, jail opens as apartments in Covington. Cincinnati Business Courier. https://www.bizjournals.com/cincinnati/news/2023/03/20/former-jail-administration-building-apartments.html.